Articles in This Series:

The next three recommendations in the Civitas Institute Agenda “20 Changes for 2010: A Primer for State Reform” focus on policies to encourage fiscal responsibility in state spending.

The problem: Unsustainable budget growth, mounting state debt and a lack of spending priorities

In 2009, North Carolina legislators found themselves having to address yet another budget crisis, the second major deficit in eight years. Rather than using the situation as an opportunity to implement meaningful spending reform, lawmakers imposed another round of “temporary” tax hikes – this time totaling more than $1 billion dollars.

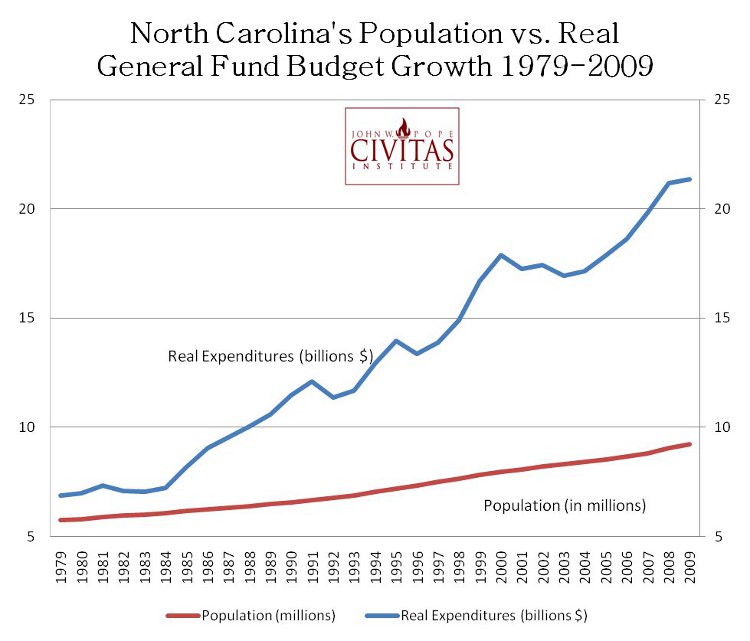

An examination of North Carolina state spending trends over the last 30 years reveals the root cause of North Carolina’s repeated budget crises: unsustainable spending growth.

Some notable observations from the data include:

- North Carolina’s state budget – even after adjusting for inflation – more than tripled in the last 30 years.

- By comparison, the state population grew by 61 percent.

- In other words, real expenditures in North Carolina’s state budget grew at more than three times the pace as population.

The pattern repeats itself time and again. During flush economic times, rather than sensibly setting aside excess funds in a rainy day fund, the state ramps up its spending commitments by adding new programs and rapidly expanding existing ones. When recession hits, spending commitments prove to be unsustainable, and a budget crisis emerges. And because short-sighted budget writers refused to set aside any significant savings during the good times, North Carolina families pay the price of legislative irresponsibility: another round of tax hikes to cover the state government’s reckless spending.

In addition to short-sighted, irresponsible spending increases, North Carolina state government faces alarming levels of state debt and unfunded liabilities. State debt, measured as principle plus interest owed calculated as of June 30, 2008 (the latest data available) is $9.4 billion. That figure is more than half of all state tax revenue collected in fiscal year 2008-09.

Furthermore, North Carolina also faces a $29 billion unfunded liability for state retiree health benefits. At a combined $38.4 billion, this means an average North Carolina family of four is saddled with nearly $17,000 in debt and unfunded liabilities.

A recent Debt Affordability Study released by the State Treasurer, in fact, concluded that the state has virtually exhausted its debt limit and its AAA bond rating may soon be in jeopardy.

North Carolina elected officials have embarked on an irresponsible long-term spending binge that hampers the state’s economy. Budget writers have proven to be incapable of reigning in their spending habits or effectively prioritizing budgetary spending. Measures to institute fiscal responsibility are sorely needed.

Solutions:

6.) Enact a teacher retiree protection act

The February 2010 Civitas Institute DecisionMaker poll asked likely voters if they would support or oppose limiting state budget growth to the growth in population and inflation with excess revenues going to fund future state retiree health benefits. Respondents were in favor by more than a 2 to 1 margin, with 52% saying they support such a measure, compared to 24% who said they oppose it.

- Out-of-control spending increases have resulted in a series of massive budget deficits.

- From FY 2004-05 to FY 2008-09, state spending outpaced inflation plus population growth by $9 billion.

- North Carolina faces $29 billion in unfunded liabilities for state retiree health benefits.

- If nothing is done to begin to pre-fund these liabilities, the benefits may be in jeopardy.

- Supporting both skyrocketing budgetary spending and unfunded retiree health benefits will require major job-killing tax increases in the future. State spending will consume such a substantial amount of available resources that economic progress will be severely curbed.

Recommendation:

- North Carolina should enact a constitutional restraint on annual spending growth tied to the growth of population plus inflation.

- Excess revenue collected will be devoted to a trust fund established to finance the promised health benefits for state retirees, most of which are teachers.

7.) Ensure a public vote on all state debt

An overwhelming 77% of voters believe that the North Carolina General Assembly should not be allowed to borrow money without voter approval (May 2008 Civitas DecisionMaker poll)

- State lawmakers have exploited an exemption to the state constitution requiring a public vote on all state debt.

- North Carolinians have been denied a vote on the addition of new state debt since 2000.

- Unsurprisingly, state debt has skyrocketed in that time.

- Per capita state debt doubled in just four years after 2000.

- Annual debt service payments have ballooned to more than two and a half times their 2000-01 levels.

Recommendation:

- Pass legislation mandating that all new issues of state debt first be approved by North Carolina voters.

8.) Clearly establish state spending priorities

- During the 2009 session, budget writers repeatedly claimed that the budget deficit will force deep cuts to education and services to the sick and needy.

- But when households face tight economic times, they first look to cut their lowest priorities. Was North Carolina’s General Assembly telling its citizens that their lowest priorities are public education and services to the sick and needy?

- Lawmakers clearly need an exhaustive method of itemizing state spending priorities.

Recommendation:

- North Carolina should implement a zero-based budgeting policy. Zero-based budgeting would simply require all state agencies to produce a thorough description and justification of their expenditures, along with a ranking of each activity as it relates to the overall goals and purposes of the agency.

- A 2009 bill (HB 45) sponsored by Reps. Holloway (R-Rockingham) and Blust (R-Guilford) would have implemented such a policy, but the bill died in committee.

- Such a process would go a long way in allowing lawmakers to identify unnecessary spending and better inform the difficult budgetary decisions they face every year.